Your Spin Off Excellence, Powered by ITP

Delve into the realm of business spin-offs, a strategic approach frequently employed to reap specific financial rewards while bolstering market goodwill and shareholder value. Initiating a spin-off is a monumental legal and organizational endeavor. Within the IT sphere, a comprehensive analysis is indispensable, encompassing legal compliance and tailored adaptations to SAP's technical infrastructure and application layer.

The Transformative Impact of SAP on Spin Offs

Spin-offs encompass various scenarios, including the establishment of a new company dedicated to managing a specific aspect of the parent company’s business, such as HR processes. They can also involve the sale of the company to another entity. Additionally, spin-offs can come into play in the unfortunate event of a parent company’s bankruptcy, a situation increasingly relevant in today’s volatile global economy.

In this scenario, the parent company may face insolvency due to financial challenges, while its subsidiary, for instance, continues to thrive, generating positive cash flows. Spin-offs provide a strategic means to navigate these complex business circumstances, ensuring the continued success of profitable subsidiaries.

Performing Spin off for SAP IBP

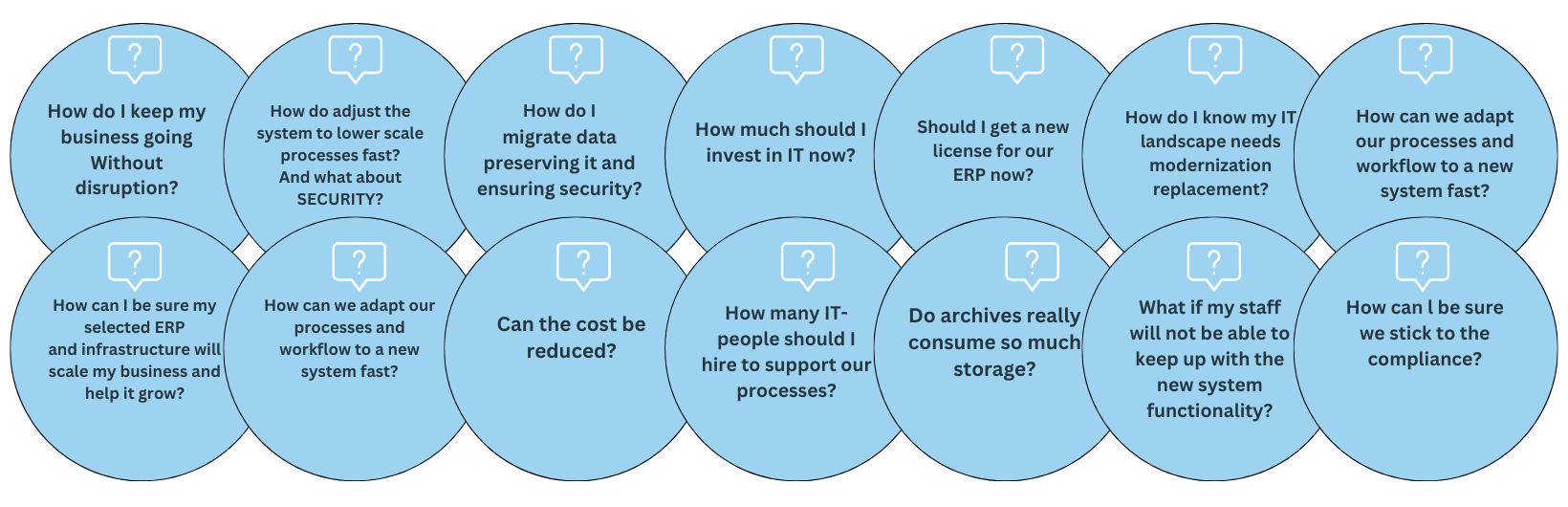

In today’s business landscape, mergers, acquisitions, and organizational restructurings are ubiquitous occurrences. These projects stand in stark contrast to typical SAP Integrated Business Planning (IBP) implementations and present unique IT challenges. To navigate them successfully, a distinct approach is imperative.

When it comes to SAP Carve-Out and Spin-off projects, there exist a multitude of approaches and options.

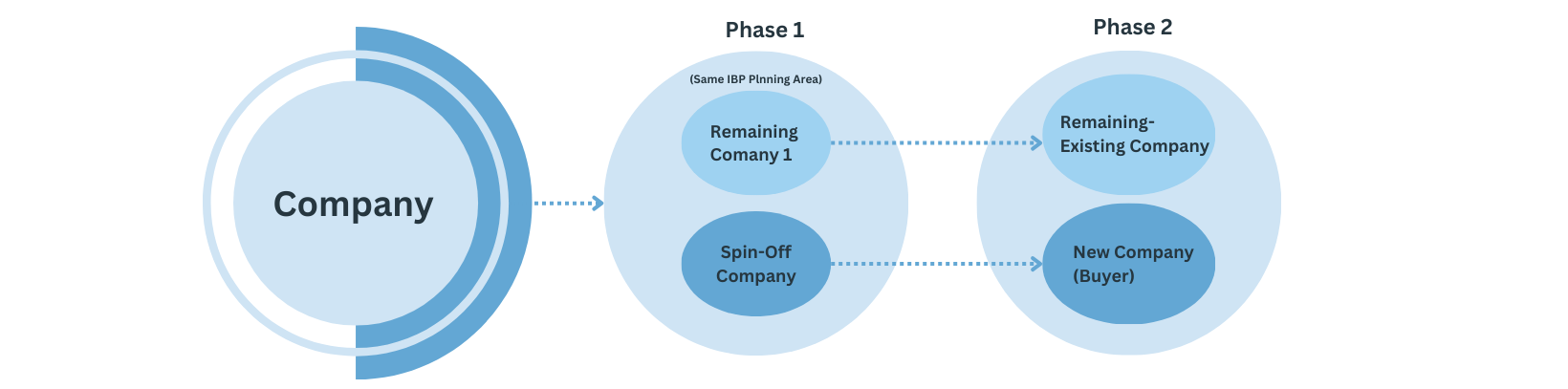

Two phases to Tackle SAP Spin Off Projects

In today’s business landscape, mergers, acquisitions, and organizational restructurings are ubiquitous occurrences. These projects stand in stark contrast to typical SAP Integrated Business Planning (IBP) implementations and present unique IT challenges. To navigate them successfully, a distinct approach is imperative.

When it comes to SAP Carve-Out and Spin-off projects, there exist a multitude of approaches and options.

The spin off of Qualtrics, a company specializing in ‘experience management,’ has resulted in a remarkable 52% surge on its debut in the market

Qualtrics, the spin-off from software giant SAP AG, experienced an impressive first day of trading during its initial public offering, with shares surging by 52%. Led by Morgan Stanley and JP Morgan, the IPO saw Qualtrics’ shares, trading under the ticker symbol “XM” on the Nasdaq, initially priced at $30. However, they quickly rose to $41.85 at the start of trading on Thursday and closed at $45.50.

The IPO generated $1.5 billion in proceeds, benefiting both Qualtrics and its parent company SAP, which will still retain the majority of Qualtrics’ stock post-offering. With a combined total of approximately 503 million class A and class B shares, the entity now boasts a market capitalization of approximately $23 billion.

Start a project with us!

Let's Do This!

ITP overview

SAP Solutions

Microsoft solutions and migration to Azure

Application and infrastructure development and support

Strategic IT outsourcing

- 28+ years in the market

- Broad partner ecosystem with 40+ vendors and partners

- Proven use of best practices and innovative technologies, confirmed by key vendors

- Team with extensive experience in complex IT projects for leading companies, including

- Development of a global SAP template and its subsequent rollout to group companies

- Migration to S/4HANA

- Setup and migration of infrastructure to Azure

- Competence center and specialists certified by SAP and Microsoft