S/4HANA in Finance: Focusing on Accounting, Controlling, Treasury and Risk Management

Table of contents

- Importance of S/4HANA in Finance

- SAP FICO: Finance and Controlling

- Key Features of S/4HANA

- Case Study for S/4HANA in Finance

- Future of Finance with S/4HANA Finance

Importance of S/4HANA in Finance

SAP S/4HANA Finance is a powerful solution for businesses to run the financial operations and make the process easier and more effective. SAP S/4HANA Finance offers a wide range of benefits that can transform your finance department and give various solutions which include a real-time reporting and analytics to integrated financial and management accounting, the system empowers finance professionals to make data-driven decisions, streamline financial processes, and finally drive business growth.

At the core of the SAP S/4HANA Finance solution’s distinctive value proposition lie the enhancements in processes and reporting, made possible by the capabilities of SAP HANA. While implementation promises many benefits, it is essential to acknowledge that the process is not without its challenges. Browse through our related article for further insights: SAP Implementation – 5 Main Challenges .

SAP ECC, initially recognized as SAP ERP Central Component, was firs introduced as a financial software suite in 1972. Since then, it has become into one of the most extensively embraced ERP solutions in the market. According to SAP press ‘ reports, SAP HANA database boasts analytics and reporting capabilities that are 1800x faster than SAP ERP.

When it comes to integrating multiple ERPs into a singular platform for data collection, it involves consolidating and unifying data from different Enterprise Resource Planning systems into a single, centralized location or database for streamlined and comprehensive data management and analysis. This includes things like the Universal Journal , centralized processing, and the ability to integrate multiple ERPs into one place for data collection. Review our related articles for additional insights: SAP S/4 HANA and SAP ECC – Key Differences .

SAP S/4HANA is used across various industries due to its broad functionality and adaptability. Some prominent industries where S/4HANA is commonly implemented include: manufacturing, retail, healthcare, financial services, utilities, telecommunications.

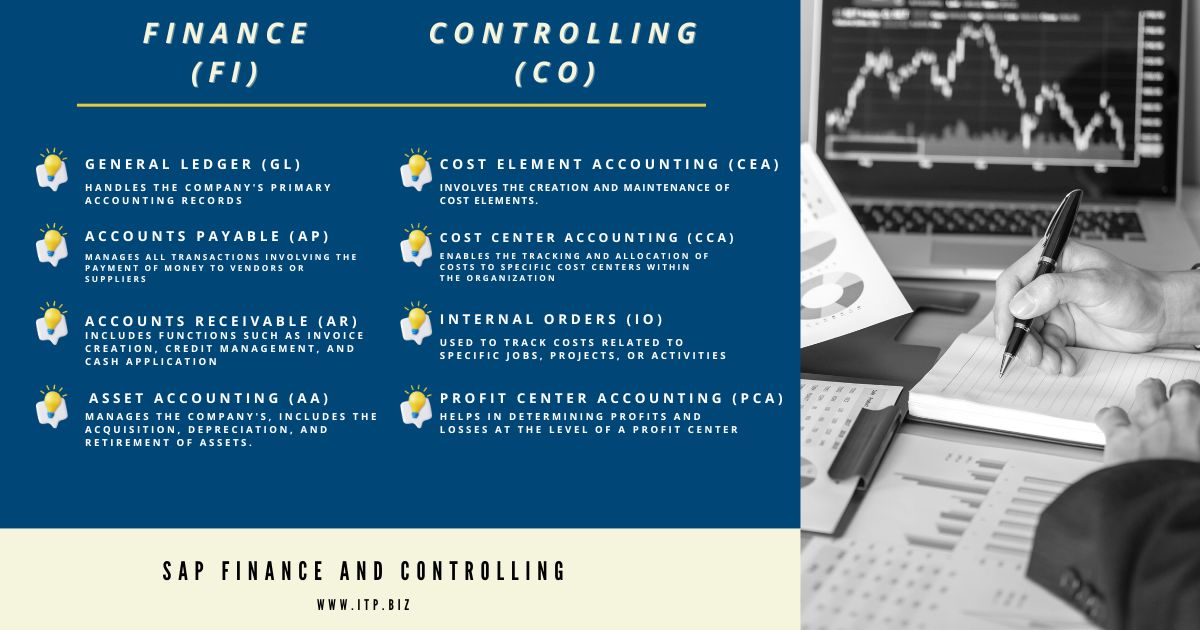

SAP FICO: Finance and Controlling

SAP Finance and Controlling (FICO) is a central component for the finance module of the ERP solution from SAP. It helps companies to manage all their financial data, generate balance sheets and make decisions for corporate planning.

SAP FICO consists of two sections, SAP Finance (FI) and SAP Controlling (CO). Each of which is used for a specific financial process. While SAP FI deals with overall financial reporting and accounting processes, and SAP CO make emphasis more closely on planning and monitoring costs. Originally SAP FI and SAP CO were created for different purposes and were seperate modules, but now their functions are firmly integrated.

SAP FICO is an important core functional component in SAP ERP Central Component that allows an organization to manage all of its financial data and also allows an organization to store a complete version of their financial transaction data. Specifically, the purpose of SAP FICO is to help companies generate and manage financial statements for analysis and reporting, as well as to aid in effective business planning and decision-making. Explore our related articles for more information: SAP Integration’s Transformative Power on the Financial Sphere of Businesses .

The main components of SAP Finance (FI):

· General Ledger (GL) that handles the company’s primary accounting records.

· Accounts Payable (AP): AP manages all transactions involving the payment of money to vendors or suppliers.

· Accounts Receivable (AR) which includes functions such as invoice creation, credit management, and cash application.

· Asset Accounting (AA) is in charge to manage the company’s, includes the acquisition, depreciation, and retirement of assets.

The main components of SAP Controlling (CO):

· Cost Element Accounting (CEA) which involves the creation and maintenance of cost elements.

· Cost Center Accounting (CCA) that enables the tracking and allocation of costs to specific cost centers within the organization.

· Internal Orders (IO) are used to track costs related to specific jobs, projects, or activities.

· Profit Center Accounting (PCA) helps in determining profits and losses at the level of a profit center.

Key Features of S/4HANA

SAP S/4HANNA Simple Finance helps to cut costs and time to handle finance as well as accounting processes, it offers a range of key features in finance that revolutionize traditional processes. SAP S/4HANA Finance solution for treasury and risk management helps the business to:

· Generate and manage financial statements for analysis.

· Enable report features.

· Provide deep analytics tools.

· Simplify Financial Processes.

· Integrate Financial and Management Accounting.

· Improve Cash Flow Management.

· Provide Analytics and Planning.

· Realize Cost Optimization.

These features collectively transform financial operations, enhancing efficiency, providing deeper insights, and enabling more agile decision-making within the organization.

Implementing S/4HANA can lead to improved efficiency, better decision-making, and a more streamlined and agile business operation, which can ultimately enhance competitiveness and profitability. However, it’s important to carefully plan and execute the implementation to realize these benefits effectively.

Case Study for S/4HANA in Finance

Let’s explore a case study that uncovers how ITP successfully integrated SAP S/4HANA into the company’s financial sector.

A global manufacturing company, faced challenges with its outdated financial systems, which hindered their ability to generate real-time insights, manage growing data volumes, and make informed strategic decisions.

The finance department at Corporation has struggled with disparate financial data sources, leading to delays in reporting, inconsistent insights, and increased manual effort for reconciliation.

The guideline and steps to take: implementation of SAP S/4HANA, implement key solutions, simplify financial processes, analyze the results and benefits.

Key Solutions Implemented:

Real-time Reporting and Analytics: S/4HANA’s in-memory computing enabled instant data processing, allowing the finance team to access real-time financial data and perform on-the-fly analysis.

Simplified Financial Processes: The integration of financial modules within S/4HANA streamlined various processes such as accounts payable, accounts receivable, and general ledger, reducing complexity and enhancing efficiency.

Unified Data Management: S/4HANA’s unified platform consolidated financial data, improving accuracy and reduced reconciliation efforts.

Results and Benefits:

Efficiency Gains: Corporation observed a 30% increase in overall operational efficiency due to streamlined processes and real-time insights.

Cost Reduction: The company realized a 25% reduction in operational costs within the first year due to reduced reconciliation and manual data handling which led to cost savings in resource management.

Enhanced Decision-Making: With real-time insights the decision-making speed increased by 40%, leading to more agile responses to market demands.

Future of Finance with S/4HANA Finance

SAP’s S/4HANA holds promising potential in shaping the future of finance. It’s designed to streamline financial processes, enhance efficiency, and offer real-time insights. With its in-memory computing, it can facilitate faster analytics, smarter decision-making, and improved financial planning.

Implementing a new SAP S/4HANA platform in can build the Future of Finance. SAP s 4 hana in Finance is a powerful solution for businesses to run the financial operations and make the process easier and more effective.

Financial leaders are not just responsible for managing the present; implementing S/4HANA can be game changing as equips financial leaders with advanced planning and forecasting capabilities that are powered by predictive analytics and machine learning. As a result, it enables the users to model different scenarios, assess the impact of strategic decisions, and allocate resources more effectively. By integrating financial planning there is a possibility to make data-driven decisions that are aligned with their organization’s long-term objectives.

In summary, SAP S/4HANA offers a comprehensive solution for finance, with the main features of bringing together real-time analytics, streamlined processes, and improved decision-making process to help organizations run their financial operations more effectively. if you are looking for a reliable partner for systematizing finance then you are in a right place. ITP provides cutting-edge digital transformation technology tailored for your business needs. Our commitment to excellence and expertise in financial solutions make us the ideal choice to streamline and optimize your financial processes. Don’t miss out on the future of enterprise solutions, contact us or book a free consultation for additional information.

Similar articles